Connecticut’s highway use fee : Full Information

The Connecticut Highway Use Fee, effective January 1, 2023, is a tax imposed on certain carriers operating heavy trucks on any state highway. The purpose of this financial commitment is to generate revenue to improve the state’s infrastructure.

Who’s Got to Pay Up CT Highway Use Tax?

If your rig tips the scales at 26,000 pounds or more and falls into the heavyweight categories of Class 8 through Class 13 (thanks to the Federal Highway Administration’s classification system), you have to pay the CT highway use fee.

How Much Are We Talking?

The Connecticut highway use tax depends on how much your vehicle weighs and how many miles you’re clocking in Connecticut. Fees start at 2.5 cents per mile for the lighter end of the heavy-duty spectrum and can go up to 17.5 cents per mile for the real heavyweights.

Below is a detailed fee table:

| Gross Weight in Pounds | Rate in Dollars | Gross Weight in Pounds | Rate in Dollars |

| 26,000-28,000 | 0.025 | 54,001-56,000 | 0.0654 |

| 28,001-30,000 | 0.0279 | 56,001-58,000 | 0.6883 |

| 30,001-32,000 | 0.0308 | 58,001-60,000 | 0.0712 |

| 32,001-34,000 | 0.0337 | 60,001-62,000 | 0.074 |

| 34,001-36,000 | 0.0365 | 62,001-64,000 | 0.0769 |

| 36,001-38,000 | 0.0394 | 64,001-66,000 | 0.0798 |

| 38,001-40,000 | 0.0423 | 66,001-68,000 | 0.0827 |

| 40,001-42,000 | 0.0452 | 68,001-70,000 | 0.0856 |

| 42,001-44,000 | 0.0481 | 70,001-72,000 | 0.0885 |

| 44,001-46,000 | 0.051 | 72,001-74,000 | 0.0913 |

| 46,001-48,000 | 0.0538 | 74,001-76,000 | 0.0942 |

| 48,001-50,000 | 0.0567 | 76,001-78,000 | 0.0971 |

| 50,001-52,000 | 0.0596 | 78,001-80,000 | 0.1 |

| 52,001-54,000 | 0.0625 | 80,001 and over | 0.175 |

How to file a CT highway use tax return via myconneCT?

First of all, you need to notify the Connecticut Department of Revenue Services of your presence on the DRS-myconneCT website. Registration is done through the myconneCT online portal.

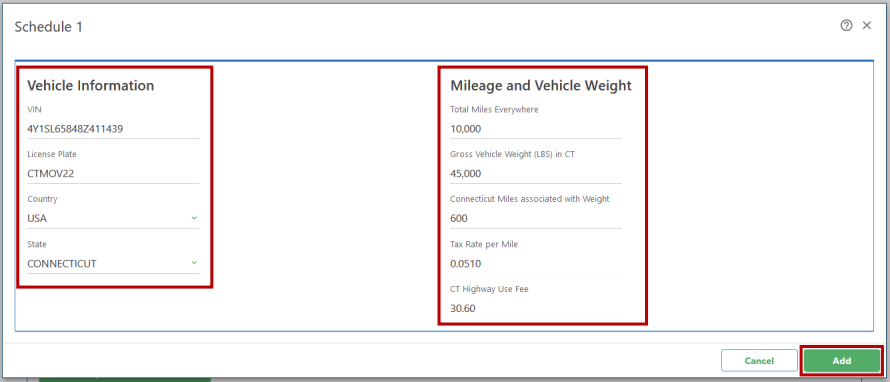

Shedule 1 information must be imported in .csv file format. Below you can find step-by-step instruction to do it clearly:

1. Download the CSV file template and populate the spreadsheet with your data as outlined in the provided guidelines.

2. Ensure that your data columns are arranged correctly to match the predefined CSV format. Double-check this layout before proceeding with the upload to myconneCT.

3. After uploading your file to myconneCT, the system will immediately begin checking for any discrepancies.

– If your file is successfully verified, you will be issued a confirmation number for your records.

– In the event of errors, a detailed list of discrepancies will be provided. Correct these issues and re-upload the file. Remember, there is no restriction on the number of times you can attempt to import your file.

Don’t Be Late Paying the CT truck tax

Initially, the state wanted updates every month, but as of October 1, 2023, they’re cool with checking in quarterly. Just make sure you’re square with them by the last day of the month after the quarter ends.

Drag your feet on filing or paying, and you’ll face interest and penalties. Interest stacks up at 1% per month, and if you’re late, expect a penalty of 10% of what you owe or $50, whichever hits harder.